|

How long have UVa people been lamenting ever decreasing state funding, even to the point of talks about maybe taking UVa private?

From the link below:

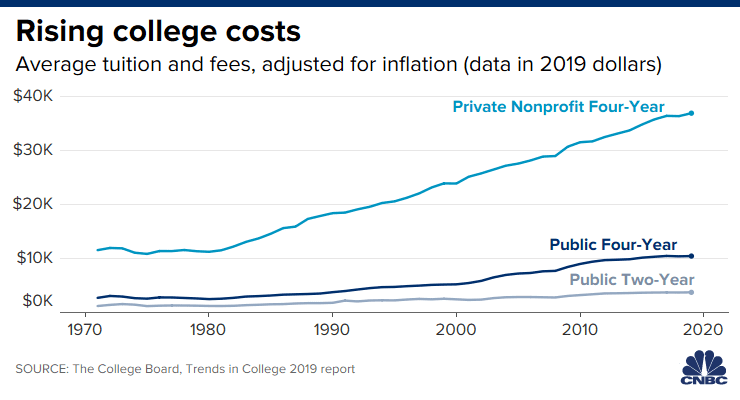

For decades now, the total cost of both four-year public and four-year private college has skyrocketed, even after accounting for inflation, leaving millions of Americans is debt for their education.

Today, borrowers owe a combined $1.7 trillion. But it didn’t have to be this way.

Legislation like the GI Bill, the National Defense Education Act and Higher Education Act of 1965 provided greater access to college and enrollment grew while costs remained low.

Eventually, deep cuts in state funding for higher education paved the way for significant tuition increases and pushed more of the costs of college onto students.

These days, tuition accounts for about half of public college revenue, while state and local governments provide the other half. But a few decades ago, the split was much different, with tuition providing just about a quarter of revenue and state and local governments picking up the rest.

Over the 30 years between 1991-92 and 2021-22, average tuition prices more than doubled, increasing to $10,740 from $4,160 at public four-year colleges, and to $38,070 from $19,360 at private institutions, after adjusting for inflation, according to the College Board.

Wages haven’t kept up.

“Household income has been stagnant,” higher education expert Mark Kantrowitz told CNBC previously.

Because so few families could shoulder the rising cost of college, they increasingly turned to federal and private aid to help foot the bills.

Since 2008, there was a shift to a “high-tuition, high-aid” model, where colleges raise tuition and increase grant aid, according to Emily Cook, an assistant professor of economics at Tulane University.

“The federal government should get out of the student loan business,” Diana Furchtgott-Roth, an economics professor at George Washington University and former chief economist at the U.S. Department of Labor, told CNBC.

With nearly no limit on the amount students can borrow to help cover the rising cost of college, “there is an incentive to drive up tuition,” she said.

Now, “schools can charge as much as they want,” Furchtgott-Roth added.

Once families hit their federal student loan limits, they turn to parent student loans and private financing to be able to send their children off to college, an increasingly necessary step for people to have a decent shot at landing in the middle class.

More and more students feel they need to go to graduate school to be competitive in the job market. And more time in school means more costs, and a greater need for borrowing. Around 40% of outstanding federal student loan debt is now taken on post-college for master’s and PhD programs.

The average student debt balance among parents was more than $35,000 in 2018-19, up from around $5,000 in the early 1990s.

Meanwhile, the private student loan market has grown more than 70% over the last decade, according to the Student Borrower Protection Center. Americans now owe more in private student loans than they do for past-due medical debt or payday loans.

Every year millions of new students are pumped into the student loan system while current borrowers struggle to exit it.

Graduates choose longer, costlier payment plans

Many recent college graduates can’t afford the standard 10-year repayment timeline, according to Kantrowitz.

“Generally, people choose the repayment plan with the lowest monthly payment, which is also the plan with the longest term,” he said.

As a result, it takes people 17 years on average to pay off their education debt, data by the U.S. Department of Education shows.

Many borrowers put their loans on hold through forbearances, which cause their debt balances to mushroom with interest, and widespread failures in the government’s forgiveness programs have left those who expected to have their debt written off after a certain period still shouldering it.

|

Thank goodness!! One of the dumbest ideas I've seen in years. Our gov't -- GoochlandHoo 06/30/2023 11:47AM

Thank goodness!! One of the dumbest ideas I've seen in years. Our gov't -- GoochlandHoo 06/30/2023 11:47AM One could argue this was a much bettter use of resources -- SPYCAV 06/30/2023 11:59AM

One could argue this was a much bettter use of resources -- SPYCAV 06/30/2023 11:59AM And that is a really sad indicator about how our treasure is being. -- GoochlandHoo 06/30/2023 12:08PM

And that is a really sad indicator about how our treasure is being. -- GoochlandHoo 06/30/2023 12:08PM You know these are Department of Ed (not private) loans we’re talking about -- WahooRQ 06/30/2023 12:38PM

You know these are Department of Ed (not private) loans we’re talking about -- WahooRQ 06/30/2023 12:38PM Its all relative. Both are really dumb. Now, if you want to talk about -- GoochlandHoo 06/30/2023 12:47PM

Its all relative. Both are really dumb. Now, if you want to talk about -- GoochlandHoo 06/30/2023 12:47PM